Pay employees how and when they want – direct deposit, paycard or check.

Move closer to 100% electronic pay.

Explore an ADP SmartCompliance Demo Support for Existing Clients

Today’s workforce is evolving and expects more flexible and convenient pay options. Keeping up with the many ways your employees want to receive and manage their pay can be difficult and time-consuming. Let ADP help by putting you on the fast track to embrace the future of pay.

ADP can be your single source for handling all your payroll options, including:

Regardless of which pay methods you choose, ADP delivers secure anytime access to pay, tax and account information via myADP and the ADP® Mobile Solutions app – for both active and former employees.

Wisely® Pay Paycard is a modern pay solution that helps you move to 100% paperless pay while also providing employees with a flexible paycard or reloadable account pay option.

In addition to flexible pay, Wisely offers:

Direct deposit helps virtually eliminate the need for paper checks by electronically depositing payroll funds directly into your employees’ accounts.

Our industry-leading check disbursement option is backed by a dedicated and secure production and distribution center with 10 check fraud protection features. A single-source vendor allows the check to be quickly generated and sent precisely where it needs to go. The checks can also be personalized and include expanded check and earnings statements.

Lessen administrative burden with a single and complete solution for all payment types.

Achieve nationwide compliance for all payment options – even the most stringent termination pay requirements – across all state jurisdictions.

Reduce costs by virtually eliminating printing and distribution expenses, especially from electronic pay statements and other vendor costs.

Attract and retain talent by paying employees how and when they want – including on-demand pay, off-cycle pay and emergency pay.

1Paycards: Generational Trends Shaping the Future of Worker Pay, ADP Research Institute

Manage pay anywhere, anytime with a mobile-first experience that lets employees access electronic pay statements, pay bills, make purchases, and take advantage of the Wisely paycard digital wallet.

Enjoy a choice of pay options, including instant and off-cycle payments and the ability to split pay.

Empower financial wellness with tools for money management, saving, access to earned wages and low-to-no card fees.

Driving change – especially payroll change – is hard. It’s also essential if you want to attract and retain employees. That’s why ADP helps you remove barriers to electronic pay. With ADP, you can:

As the largest payroll provider in the United States, ADP is the trusted name in payroll solutions.

ADP moves $2.7 trillion in US client funds yearly*

direct deposits

processed yearly*

electronic and paper pay statements issued*

W-2s issued yearly*

* 2022 ADP data

Targeted solutions for workforce, HR and business challenges

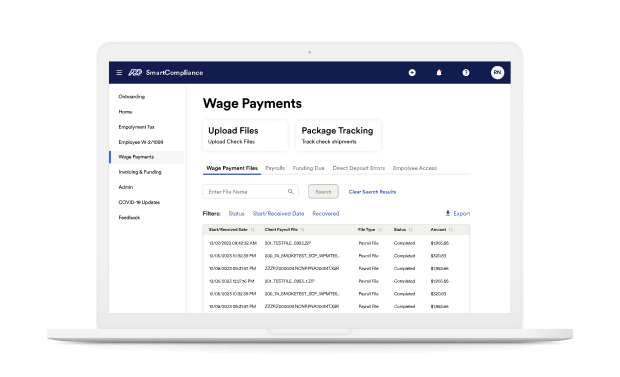

ADP SmartCompliance is a suite of technology solutions backed by ADP’s experts to help you simplify compliance complexity, close technology gaps and minimize business disruptions.

The Wisely Pay card is issued by Fifth Third Bank N.A., Member FDIC ,or MetaBank®, N.A., Member FDIC. pursuant to a license from Visa U.S.A. Inc. ADP is a registered ISO of Fifth Third Bank N.A. or MetaBank, N.A. ADP is a registered ISO of MB Financial Bank. ADP, the ADP logo, ADP SmartCompliance, and ADP A more human resource are registered trademarks of ADP, Inc. Apple Pay is a registered trademark of Apple Inc. Google is a registered trademark of Google, Inc. All other marks are the property of their respective owners. Copyright © ADP, Inc. All rights reserved.