Monitor and mitigate payroll tax risk.

Maintain control and visibility.

Explore an ADP SmartCompliance Demo Support for Existing Clients

Keeping up with payroll tax laws and requirements is a challenge. However, as a midsized (50-999 employees) or large business (1000+ employees), you can reduce many of the time-consuming tasks without compromising your visibility into the entire process with the help of ADP SmartCompliance – even if you don’t use ADP for payroll.

ADP SmartCompliance for payroll tax is a comprehensive tax filing and remittance solution that lets you spend less time chasing jurisdictional changes or updating IT systems, and more time focusing on important business goals.

Explore ways to embrace change to work for you with our Payroll Tax Guide – so you’re prepared when they occur.

With national reach and local insight, our systems are set up to align with today’s employment tax-related compliance requirements. This means you get:

Need to get started, but require registration in a jurisdiction or two? Check out our Registration Services.

The ADP SmartCompliance for payroll tax is continually updated with specific jurisdictional requirements, helping to ensure that you can quickly and accurately:

*ADP internal data

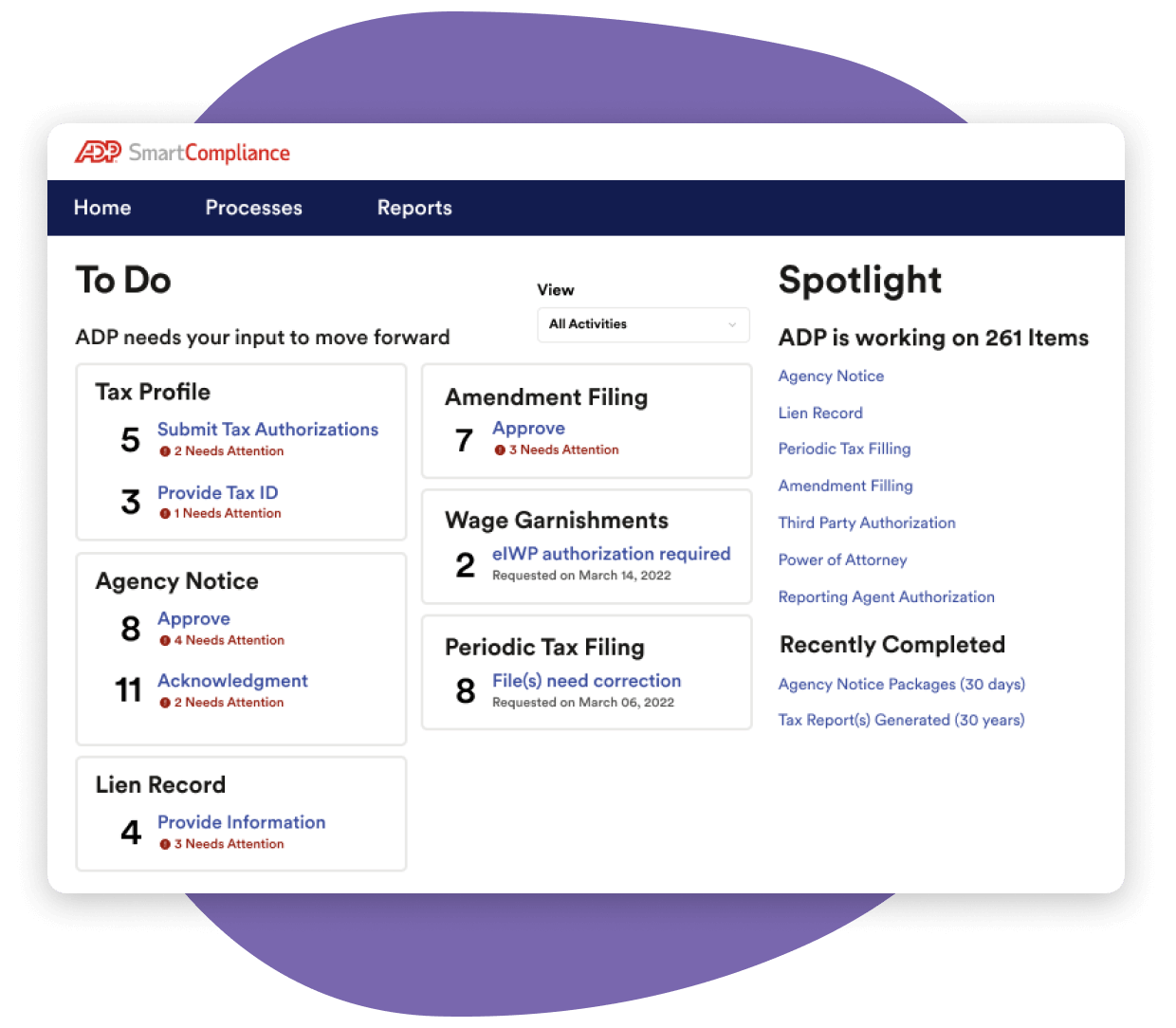

As an ADP SmartCompliance client, you’ll have 24/7 online access that puts everything you need to know at your fingertips and helps you prioritize any actions required of you, including:

With a dedicated and experienced account manager and advanced analytics tools, you get the support and insights you need to help you reduce risk. With ADP, you can:

As a result of partnering with ADP, not only have we been able to hold the line on headcount, we’ve also been able to change up the staffing to have them do more value-added processes rather than just pushing papers around and licking envelopes.

Steven Baumann,

Payroll Controller

Seminole Gaming, Hard Rock Support Services

Targeted solutions for workforce, HR and business challenges

ADP SmartCompliance is a suite of technology solutions backed by ADP’s experts to help you simplify compliance complexity, close technology gaps and minimize business disruptions.