Leveraging independent contractors is often one of the most efficient ways to enhance business capabilities and scale quickly. In fact, 74% of respondents in a recent MIT study1 believe effective management of independent contractors is critical to their success.

However, independent contractor management can be time consuming, and many business owners find they lack the visibility and control necessary to understand the impact of this growing workforce. The aforementioned MIT survey identified only 30% of respondents who were prepared to manage independent contractors.

Historically, most organizations have located, managed and paid their independent contractors using disparate tools, such as spreadsheets, phone calls and email. The end result is a fragmented, manual process that limits efficiency and scalability. Contractor management software is designed to solve these challenges by automating and streamlining every aspect of managing independent contractors.

Table of Contents

What is contractor management software?

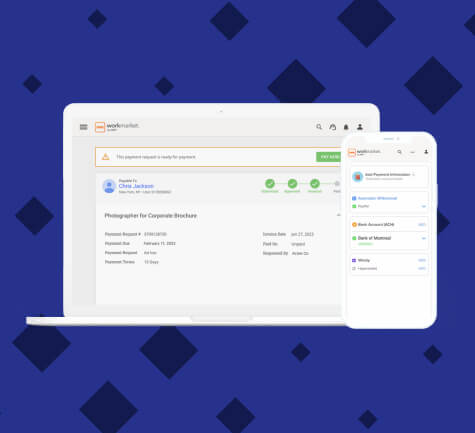

A CMS, or contractor management software, is a centralized cloud-based tool that helps organizations automate the processes of onboarding independent contractors, managing their assignments and paying them.

Businesses using contractor management software may experience the following:

- Easier to find more qualified independent contractors

- Automated and self-driven (worker) onboarding

- Larger pools of qualified contractors based on skills, credentials and qualification requirements

- Organized groups of talent allowing for faster mobilization

- Simplified management of on-site and off-site work assignments

- Fast and flexible e-payment options, including international payments

- Increased productivity and performance

- Enhanced control and forecasting of independent contractor spend

- Improved communication and engagement with workers on the go

Contractor management software also has guardrails that help organizations support compliance and it generates an auditable paper trail for proper tax reporting.

Features of contractor management systems

A CMS provides an end-to-end platform and single source of data that allows businesses to manage their independent contractors more efficiently. It’s often customizable, so organizations can integrate a CMS with their existing systems and only utilize the features they need.

Specific features of a contractor management system may include:

- Talent identification and invitations

- Verification tools to help validate skills, credentials and qualifications of contractors

- Dynamic organization of talent based on skill sets, geography and more

- Engagement solutions, such as mobile applications, that simplify communication

- Assignment management, including routing, tracking and deliverable checks

- Payment options that allow businesses to set terms and workers to choose how they get paid

- Open APIs and dedicated tools for integrating into current systems

What are the benefits of contractor management software?

Contractor management systems can substantially reduce or virtually eliminate once-tedious and manual tasks, allowing businesses to spend their time in smarter ways. With a CMS, organizations may also be able to:

- Identify and onboard contractors easier

Customizable landing pages help reduce administrative errors and streamline the process of onboarding new talent. - Organize talent and verify their performance ability

Pre-defined talent pools use automated algorithms to send invites to qualified workers immediately. - Manage assignments

Built-in coverage maps help businesses identify labor gaps. They can then create assignments quickly using templates that share common information across projects and automatically dispatch a qualified contractor to the job. - Deliver critical analytics and insights

Executive-level dashboards and automated reports provide organizations with important data about their independent contractor workforce. These metrics can help control budget allocations and spend utilizations. - Enhance payment capabilities

Automated invoicing and multiple e-payment options allow businesses to pay independent contractors securely, reliably, globally and on their terms. - Help mitigate compliance risk

A CMS provides a single data source, capturing all independent contractor documents (NDAs, certifications, licenses, etc.), invoices and annual 1099-NEC forms. Additionally, automated workflows help verify tax IDs and file Form 1099-NECs with the IRS. - Provide a more seamless experience for workers

By reducing administrative burdens and providing faster, more flexible payment options, as well as a seamless onboarding experience and a mobile application, a CMS makes life easier for contractors. They may be more likely to accept future assignments from an organization as a result.

Challenges of managing independent contractors

Businesses across the world work with independent contractors because it allows them to easily expand their reach into previously untapped markets. But these locations are often outside the organization’s legal operating address and compliance can vary by state and country. There may be different filing and reporting requirements, withholding obligations and much more.

Another challenge with managing independent contractors is that they are not paid on a consistent schedule like employees, nor do they have employment-related taxes deducted from their payments. When filing taxes, both the payor and the contractor must report how much the contractor earned.

Contractor management systems help organizations overcome these challenges because they offer an auditable paper trial. The necessary information about the worker, the assignment, the payment and the location are all saved in a centralized solution. As a result, businesses can easily report and recall any information with just a few clicks.

Who should use a CMS?

The more independent contractors an organization works with, the harder it can be to manage them and their assignments. It may be time to explore contract management systems if a business:

- Expends significant resources managing a large number of independent contractors

- Is looking to integrate service ticketing solutions and enterprise resource planning solutions to streamline the process of routing and paying contractors

- Wants line managers to be more agile and serve clients faster

- Needs help complying with corporate, jurisdictional or industry requirements, laws or regulations

- Desires payment flexibility and the ability to integrate with financial systems

- Works with a large geographic distribution of workers and wants to expand to tertiary and secondary markets

Additionally, since individual teams tend to have different independent contractor management needs, CMS usage varies across departments. Here are some common use cases by stakeholder:

- IT, marketing and sales – onboarding and vetting freelancers, monitoring projects, and checking worker availability

- HR – creating consistent onboarding processes, verifying contractors across the organization and establishing standardized contractor agreements

- Finance – storing invoices, paying contractors securely, generating paper trails for future tax filings and sharing insights on freelance expenses

- Legal – ensuring businesses meet applicable legal and regulatory requirements and properly engage with independent contractors

Frequently asked questions about contractors management systems

What does contractor management software do?

Contractor management software automates the onboarding, organization, management and payment of independent contractors.

How much does contractor management software cost?

CMS costs depend on several factors. When talking to potential vendors, organizations may need to answer these questions for a quote:

- How many contractors do you manage?

- Do you need to pay per project?

- How much do you spend in a fiscal year?

- How much ongoing support will be required?

What's the difference between an independent contractor and an employee?

Employees and independent contractors (sometimes referred to as contingent workers) are legal terms that tell organizations which “benefits” and “rights” are assigned to the individual providing the service. For example, employees are generally told when, where and how they work, whereas independent contractors are often free to make those decisions on their own. This worker classification checklist can help organizations determine if a worker should be classified as an employee or an independent contractor.

How do I manage payroll for contractors?

Managing payroll for contractors is the process of gathering invoices, verifying completion of the project and processing payment based on a predefined set of payment terms.

How do I pay international contractors?

Just like domestic independent contractors, international contractors need to submit an invoice, verify the completion of the work and agree to payment terms. However, the process will likely also need to involve currency exchanges. Having a solution to send payments across borders and help manage international currency exchange fees is critical.

How does contractor management work?

Contractor management helps make sure all parties are clear on the scope of work, responsibilities, timelines, payment terms and deliverables. This process includes:

- Finding the most qualified worker for the job

- Onboarding the contractor and verifying licenses

- Ensuring all internal company requirements are met

- Receiving proof of the completed project

- Paying the worker as agreed upon at the start of the contract

This guide is intended to be used as a starting point in analyzing contractor management software and is not a comprehensive resource of requirements. It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services.